Top Guidelines Of Personal Loans copyright

Top Guidelines Of Personal Loans copyright

Blog Article

The Basic Principles Of Personal Loans copyright

Table of ContentsPersonal Loans copyright Can Be Fun For AnyoneA Biased View of Personal Loans copyrightSome Known Details About Personal Loans copyright All about Personal Loans copyrightRumored Buzz on Personal Loans copyright

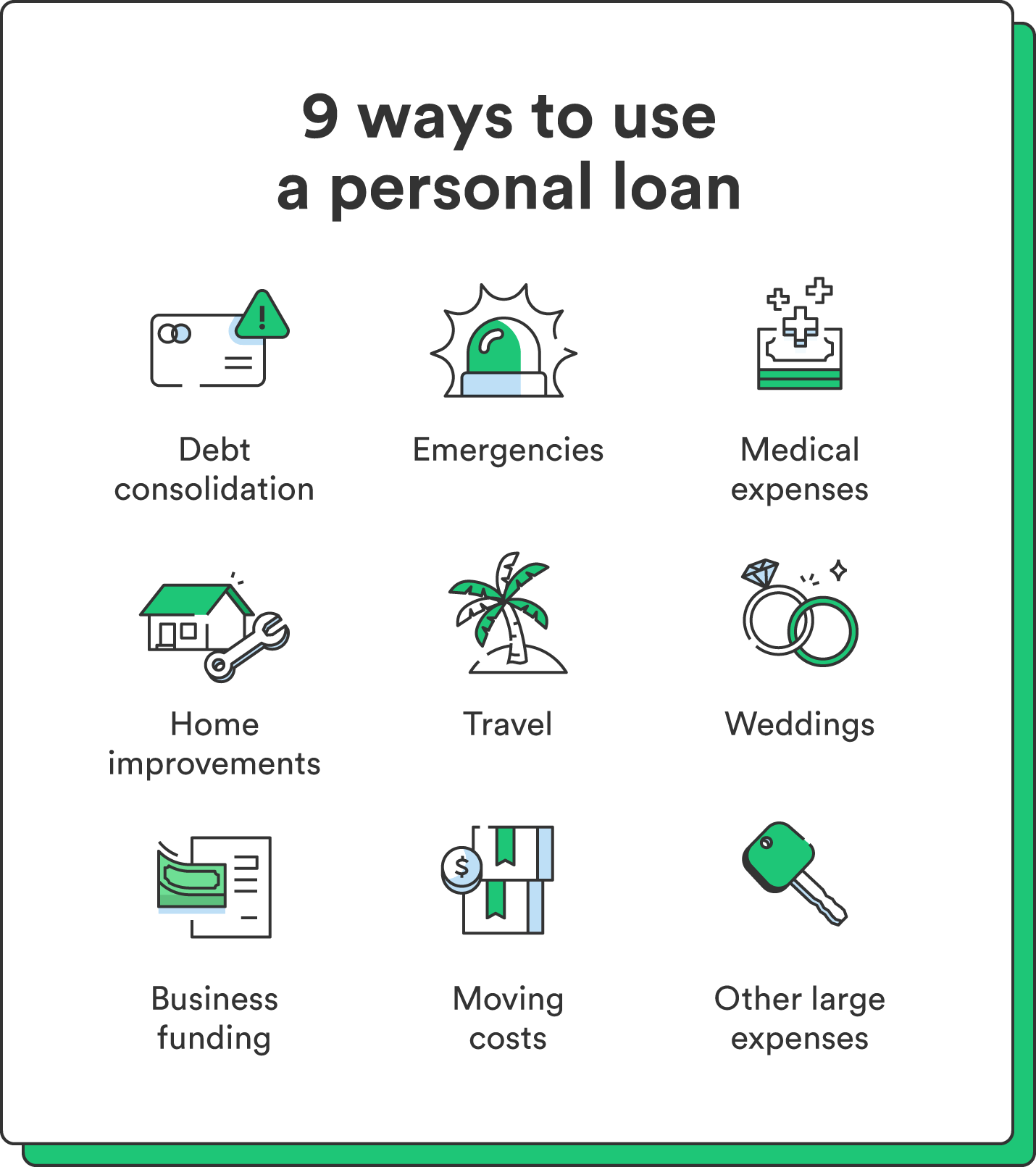

Let's study what an individual financing actually is (and what it's not), the factors people utilize them, and how you can cover those insane emergency situation costs without handling the burden of debt. A personal financing is a round figure of cash you can obtain for. well, practically anything.That doesn't include obtaining $1,000 from your Uncle John to aid you pay for Xmas offers or allowing your roomie spot you for a couple months' rental fee. You should not do either of those points (for a variety of factors), yet that's technically not a personal funding. Personal loans are made through an actual economic institutionlike a financial institution, lending institution or online lending institution.

Let's take a look at each so you can know precisely just how they workand why you do not need one. Ever before.

The 30-Second Trick For Personal Loans copyright

No issue exactly how excellent your credit scores is, you'll still have to pay passion on the majority of personal car loans. Guaranteed individual financings, on the other hand, have some sort of collateral to "safeguard" the funding, like a boat, jewelry or RVjust to name a couple of.

You can additionally secure a safeguarded individual finance utilizing your auto as collateral. That's a harmful move! You do not desire your major mode of transport to and from work obtaining repo'ed since you're still paying for in 2015's cooking area remodel. Trust us, there's absolutely nothing safe concerning safe lendings.

Just because the settlements are predictable, it does not indicate this is an excellent offer. Personal Loans copyright. Like we claimed in the past, you're virtually assured to pay passion on a personal funding. Just do the math: You'll wind up paying means a lot more over time by obtaining a lending than if you would certainly just paid with cash

The 8-Minute Rule for Personal Loans copyright

And you're the fish holding on a line. An installment funding is an individual financing you pay back in fixed installments gradually a fantastic read (generally when a month) until it's paid completely - Personal Loans copyright. And don't miss this: You have to pay back the original car loan quantity prior to you can obtain anything else

Do not be mistaken: This isn't the exact same as a credit card. With personal lines of credit, you're paying passion on the loaneven if you pay on time. This sort of loan is very difficult since it makes you think you're managing your financial debt, when really, it's handling you. Payday advance.

This one gets us provoked up. Why? Because these organizations prey on individuals who can not pay their costs. And that's simply incorrect. Technically, these are short-term car loans that provide you your paycheck in advance. That might seem hopeful when you're in a financial accident and need some money to cover your expenses.

Excitement About Personal Loans copyright

Why? Due to the fact that things obtain actual untidy actual fast when you miss a settlement. Those financial institutions will certainly follow your pleasant granny who check over here cosigned the finance for you. Oh, and you ought to never guarantee a lending for any individual else either! Not only might you obtain stuck with a funding that was never ever indicated to be yours to begin with, yet it'll spoil the connection before you can claim "pay up." Trust us, you don't wish to be on either side of this sticky circumstance.

All you're really doing is making use of brand-new financial obligation to pay off old financial obligation (and expanding your funding term). Firms recognize that toowhich is specifically why so many of them supply you consolidation fundings.

And it begins with not obtaining any kind of more money. Whether YOURURL.com you're assuming of taking out a personal car loan to cover that cooking area remodel or your frustrating credit score card bills. Taking out debt to pay for points isn't the method to go.

The Main Principles Of Personal Loans copyright

The best point you can do for your monetary future is obtain out of that buy-now-pay-later frame of mind and say no to those spending impulses. And if you're considering a personal loan to cover an emergency situation, we get it. However borrowing cash to spend for an emergency only intensifies the stress and difficulty of the circumstance.

Report this page